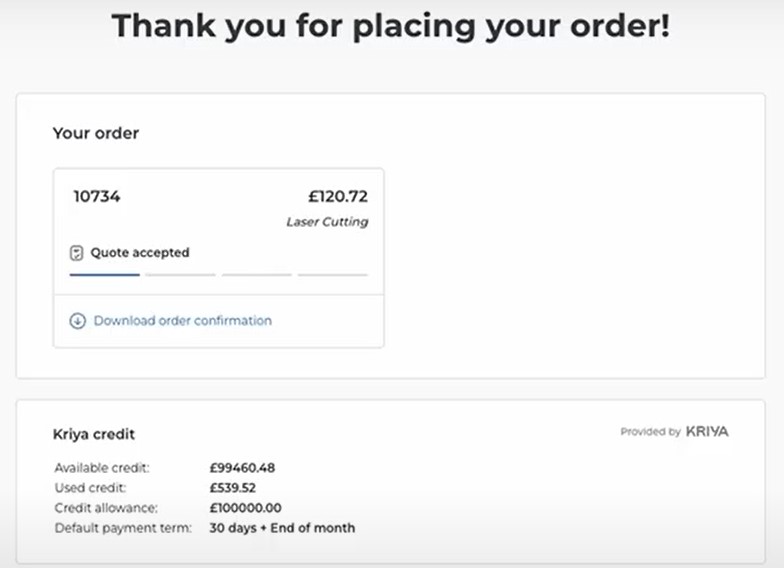

Get 30-day + end-of-month payment terms in a matter of minutes.

You can now improve your cash flow by using the Buy Now, Pay Later feature Fractory offers in cooperation with Kriya.

What are the pros?

- No cash required upfront

- Credit limits to suit your needs (the check is done online and takes only minutes)

- There is no extra cost

- The are no cons

How to get Kriya’s Buy Now, Pay Later?

- Go to the “Company account” tab

- Under “Payment terms”, click “Apply now” and you’re good to go

FAQs about Kriya

Why are we offering Kriya Payments?

We are partnering with the best finance providers to give you more flexible credit options when paying for their services and more time to pay. Kriya Payments is an innovative way to help you pay from Kriya.

How does Kriya Payments work?

When you use Kriya Payments at checkout, you can choose to pay in 30 days or at the end of the following month, at no extra charge. We’ll confirm your payment choice with you via email, along with your agreed payment plan and our account details. We’ll remind you when it’s time to pay and you can organise via bank transfer.

Will this affect my credit score?

Before you can start paying later with Kriya Payments, we’ll perform a soft credit search on your business to check if you’re eligible. These kinds of searches have no impact at all on your credit score. If you pass this, Kriya Payments will be activated on your account. The first time you choose to pay with Kriya Payments at checkout, a hard search will be made (this will only happen on the first purchase). The search will appear on your credit report. Multiple hard searches in a short period of time may affect your credit score.

Who is Kriya?

Kriya is a leading UK FinTech and embedded finance platform for businesses that has been operating for 11 years. They deliver flexible finance solutions to solve the cash flow issues that get in the way of progress and have processed over £20bn in payments for UK businesses. Kriya Payments is their embedded credit product that lets businesses pay later online at checkout.

What does it cost?

There are no extra fees if you pay with Kriya Payments, as long as you settle your invoice when it’s due based on your selected payment terms.

Can I increase my limit?

If you enjoy paying with Kriya Payments but want access to a higher limit then sometimes we’re able to increase it. Making sure you successfully repay invoices on time can increase the likelihood of this. We would need a minimum of either 1 successful repayment + Open Banking connection or 3 successful repayments to consider any limit increase requests.

Further reading on Kriya’s blog:

How does buy now, pay later work in B2B?

How Kriya uses open banking to make accessing credit easier?